Introduction

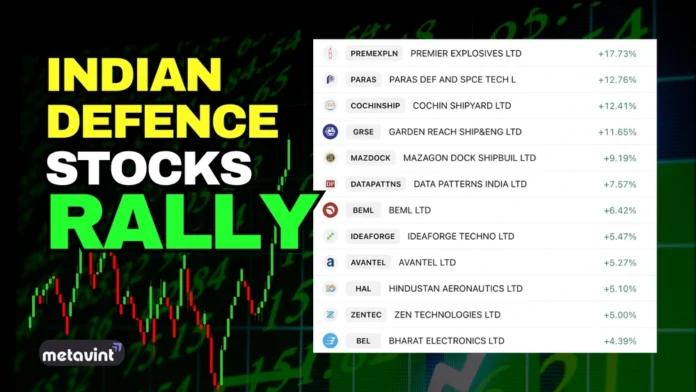

On May 16, 2025, Indian defence stocks delivered one of their strongest performances in recent months, with multiple companies reaching new 52-week highs and several logging double-digit gains. Backed by robust order books, favorable government policies, and the success of Operation Sindoor, the defence sector outperformed the broader markets and captured investor attention.

This article presents a detailed analysis of stock movements, top performers, market sentiment, and future outlook — essential for investors evaluating opportunities in the sector.

Market Snapshot: May 16, 2025

| Company | Price (₹) | % Change | Notable Highlights |

|---|---|---|---|

| Paras Defence & Space | 1,799.50 | +19.8% | Net profit up 116.93% YoY; 52-week high |

| Cochin Shipyard | 1,962.30 | +13.0% | Strong order book; built INS Vikrant |

| GRSE | 1,489.25 | +10.0% | ₹25,000 Cr warship order book; export contracts |

| Data Patterns | 2,868.20 | +9.3% | Demand for electronic warfare systems |

| Astra Microwave | 1,072.80 | +7.0% | Radar tech, AMCA project |

| HAL (Hindustan Aeronautics) | 5,127.70 | +5.4% | ₹94,000 Cr order book; 52-week high |

| Zen Technologies | 1,794.80 | +5.0% | Demand for defence simulators, drone tech |

| BEL (Bharat Electronics) | 363.90 | +3.85% | ₹76,000 Cr order book; 52-week high |

| BDL (Bharat Dynamics) | 1,842.00 | +1.97% | Missile systems; PE ratio 119.38 |

| Mazagon Dock Shipbuilders | 3522.40 | +10.68% | Naval projects; 52-week high |

The Nifty India Defence Index surged 5.5%, closing at 8,308.15, vastly outperforming the Nifty 50, which declined 0.34%.

Key Drivers Behind the Surge

1. Operation Sindoor: Strategic Confidence Boost

The success of Operation Sindoor, a domestic military campaign showcasing India’s indigenously developed defence technology, has significantly increased investor confidence. The operation reinforced expectations for continued government procurement and accelerated modernisation of the armed forces.

2. Rising Geopolitical Tensions

Increased border tensions, especially with Pakistan, have historically triggered higher budget allocations and expedited defence deals. The current climate signals stronger demand for homegrown defence infrastructure.

3. Government Spending and Policy Support

- The FY25 defence budget was raised by 4.72% to ₹6.21 lakh crore.

- The government approved ₹80,000 crore in new deals, including drones, submarines, and radar systems.

- Policies like ‘Atmanirbhar Bharat’ and ‘Make in India’ continue to favor domestic players over imports.

4. Strong Order Books

High visibility of future revenues remains a core attraction:

- HAL: ₹94,000 crore

- BEL: ₹76,000 crore

- Mazagon Dock: ₹38,561 crore

- GRSE: ₹25,000 crore

These numbers reflect both domestic and international contracts.

5. Export Growth

India’s defence exports reached $2.63 billion in FY24, with a target of $15 billion by FY26. Companies like GRSE and Mazagon Dock are capitalizing on global demand for naval vessels and modular platforms.

6. Market Sentiment and Technical Strength

The Nifty India Defence Index scored 99 in relative strength (RS), with a 54% rise over the past month. Several X posts from analysts and investors indicated heavy accumulation in select defence names, signaling sustained bullish sentiment.

Caution for Investors

While the long-term fundamentals remain strong, investors should consider the following risks:

High Valuations

Some defence stocks are trading at stretched PE multiples:

- Paras Defence: PE 114.25

- BDL: PE 119.38

These levels may not be sustainable in the short term.

Profit Booking Risk

After sharp gains (up to 50% over two weeks), investors may look to book profits, potentially triggering short-term corrections.

Geopolitical Sensitivity

The sector is sensitive to geopolitical events. A sudden de-escalation could dampen sentiment, as seen during the ceasefire pullback on May 12.

FY26 Budget Expectations

Early feedback indicates disappointment over the capital expenditure share (27.66%) in the FY26 interim budget, which could limit future upside unless revised.

Outlook: What’s Ahead for Defence Investors?

The Indian defence sector presents a promising long-term opportunity, supported by:

- Government backing for domestic manufacturing

- Rapid export growth

- Healthy financial performance

- Increased global visibility

Technical indicators suggest more upside if key players like HAL and BEL continue their trend. However, investors should remain vigilant about valuation levels and real-time policy developments.

Actionable Tip: Consider phased entry, monitor Q1 FY26 results, and track government procurement announcements.

Conclusion

May 16, 2025, stands out as a landmark session for Indian defence stocks. Leading players like Paras Defence, Cochin Shipyard, HAL, BEL, and GRSE posted strong gains backed by high earnings, strategic relevance, and strong government support.

While the bullish narrative is intact, prudent investing calls for a balance between optimism and caution. For investors focused on long-term growth aligned with India’s strategic imperatives, defence remains one of the most compelling sectors in 2025 — albeit with volatility along the way.

Disclaimer

This article is for informational purposes only and based on publicly available data and sentiment as of May 16, 2025. Investors are advised to conduct independent research or consult a financial advisor before making any investment decisions.